Governor Murphy among named defendants in complaint seeking justice for municipal foreclosure victims

Trenton, N.J. (December 11, 2023) – Emboldened by the recent U.S. Supreme Court decision outlawing “home equity theft” in Minnesota property foreclosures, Cape May County-based lawyers filed the first class action lawsuit to repeal New Jersey’s nearly identical, “blatantly unconstitutional” law, and make restitution – estimated at more than $100 million – to thousands of foreclosed property owners over decades. The suit claims that these foreclosed property owners were victims of illicit municipal property tax lien sales that generated surplus “windfalls” dramatically greater than the taxes owed, according to the just filed complaint (R. Trout, W.Gaston, C. Lazicki v. Gov Phillip Murphy, M. Sciarrotta, CPM-L-000452-23, New Jersey Superior Court, Cape May County). The unprecedented action was filed by civil rights attorneys Oliver T. Barry and Shauna L. Friedman, of Barry Corrado & Grassi, P.C, against Gov. Phil Murphy and the head of the state’s Division of Taxation, in their official capacities.

Download Printable Case Filing (PDF) >>>

The complaint alleges that New Jersey is one of only a dozen states that continues to engage in “theft of surplus equity” from some of its most economically vulnerable citizens – throughout its 500-plus municipalities – following annual, local delinquent property tax-lien sales, despite the high court’s unanimous decision in May declaring the practice unconstitutional. The multi-count complaint, brought in N.J. Superior Court, also charges that the state’s present tax sale system “permits private investors to essentially steal a homeowner’s home equity due to the existence of a miniscule tax lien.” The assertion is documented in the experiences of the two class action lead plaintiffs and their Cape May County properties.

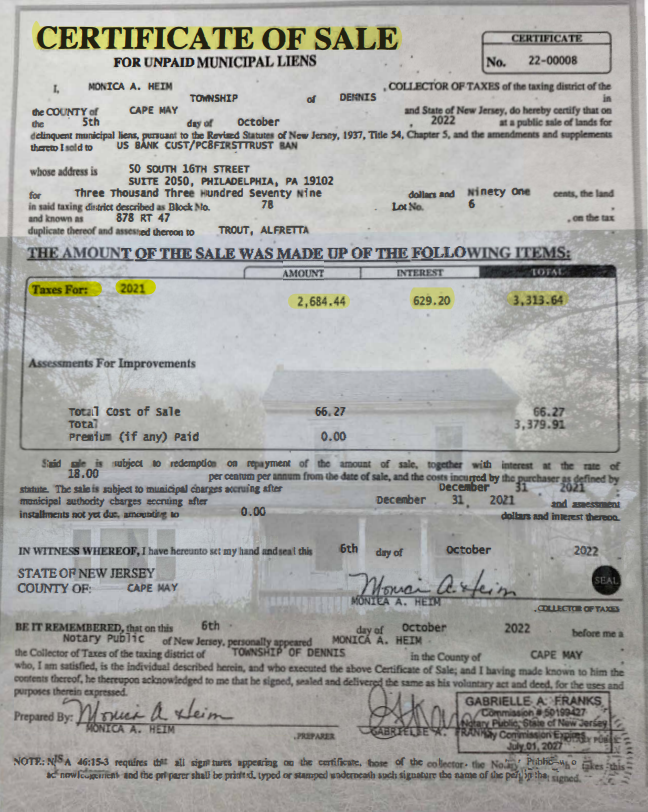

Attorney Friedman said following the landmark filing, “In the instance involving the Trout Family and their South Dennis Township home purchased in 1950, it is emblematic of victimization by local government that has no right to excessively profit from a property tax sale. We are honored to represent Ronald Trout, on behalf of his late parents, and all future class members who deserve transparency, accountability and just compensation for their measurable, devastating losses. There’s nothing legally persuasive nor morally right about New Jersey’s law, which is why it needs to be repealed.” She added, “Keep in mind that this form of government stealing from its own citizens, in cahoots with the private foreclosure ‘service’ sector, has become normalized in New Jersey, but is illegal in 36 other states.” The Trout home fell into foreclosure based on a delinquent property tax bill of $4,649. When the tax certificate from the township was purchased by a private third party, Mr. Trout recouped none of the surplus home equity amassed by his family over decades. The home value is more than $170,000.

Mr. Trout, 77, a retired carpenter, said after the filing,

“Enough is enough, this form of legalized theft of hard-earned home equity in New Jersey has got to stop, and that’s why, in the name of my parents, we filed this lawsuit. What happened isn’t only unconstitutional, it’s un-American.”

Attorney Barry said the Gaston-Lizicki property, in Middle Township, also outlined in the complaint, was bought in 2015 by the couple and it is another harrowing example of government-enabled theft. In predatory fashion, though legal under current state law, the private company that acquired the inflated tax lien through the public sale, paid it to the taxing authority, and pocketed a nearly $200,000 excess payday based on the home’s resale. “We contend the Supreme Court ruling in the Minnesota case (Tyler v. Hennepin County, May 25, 2023) directly applies to New Jersey’s tax sale law that is so clearly unconstitutional; it violates our state’s own constitution that expressly prohibits the government taking private property without just compensation and further prohibits the imposition of excessive fines, which is exactly what this is.”

Contacts:

Oliver T. Barry / obarry@capelegal.com / 609-729-1333

Shauna L. Friedman / sfriedman@capelegal.com / 609-729-1333

Steph Rosenfeld / steph@idadvisors.com / 215-514-4101